Boston Market Used To Be A Thriving Chain. What Happened?

Boston Market, an early player in the fast casual restaurant space, was once seen as America's next big restaurant chain. Built upon the popularity of its delicious rotisserie chicken, the chain was founded as Boston Chicken in 1985, then underwent an early period of rapid expansion and great success. In recent years, however, Boston Market has faltered. Restaurants have closed down, and staff members have gone unpaid. Even the company's headquarters were seized. At the time of writing, Boston Market's financial woes continue to deepen, and ploys to save the business are appearing increasingly desperate.

Numerous management changes, failed attempts to reinvent the brand, and a plethora of lawsuits have all played their part in Boston Market's downfall. These huge stressors have been compounded by the leadership of Boston Market owner Jay Pandya, whose business decisions have been ill-advised at best and catastrophic at worst. In this article, we're going to examine how all these factors led to this once-thriving chain's current fight for its life.

The chain expanded rapidly

After being founded in 1985, Boston Chicken enjoyed a period of impressive success. The company grew from one initial restaurant to 83 by 1993. That same year, Boston Chicken was floated on the stock market. Shares were sold at the high price of $20. After the initial release, the stock promptly doubled in value, reflecting the esteem in which Boston Chicken was held in.

In 1995, Boston Chicken rebranded itself as Boston Market. At the same time, the restaurant chain greatly diversified its offerings by introducing deli sandwiches and other classic dishes, such as meatloaf, to its menu. In an interview with Supermarket News, Saad Nadhir, who was vice chairman of Boston Market at the time, said, "We've always said that Boston Chicken is more than just chicken. Adding ham, turkey and [meatloaf] is a way to leverage our terrific locations, increase customer frequency and stay ahead of customer demand."

The company accelerated its expansion and grew to 970 restaurants by 1996. Boston Market also announced plans to open 2,700 further restaurants between 1996 to 2003, and was even eyeing the possibility of expanding outside the United States. These audacious plans suggested that Boston Market would open approximately 350 new restaurants per year — an incredibly difficult task for any restaurant brand to manage.

Boston Market filed for bankruptcy and was sold

In 1998, just two years after announcing its massive expansion plan, Boston Market filed for Chapter 11 bankruptcy protection. At the time of the filing, the company had lost more than $700 million. Concerns about Boston Market's business model were floating around well before the company's more dire struggles commenced; in a 1996 interview with The Los Angeles Times, analyst Damon Brundage noted, "The history of the restaurant industry is littered with the corpses of companies that were growing their store bases in excess of 25% annually and then hit the wall." Some people on Wall Street also pointed out that relatively few Boston Market restaurants ever turned a profit during the 1990s. These people correctly predicted the company's collapse.

The McDonald's Corporation purchased the Boston Market brand after it went bankrupt, absorbing 751 of its restaurants for $173.5 million. At this time, Boston Market was bigger than McDonald's other partner brands, such as Chipotle Mexican Grill. This did not mean that Boston Market received preferential treatment. In fact, many Boston Market restaurants were closed by McDonald's and converted into locations of the corporation's other fast casual brands.

McDonald's sold the brand in 2007

In 2003, The McDonald's Corporation slashed its capital spending budget by $800 million. This meant that less money was injected into the corporation's partner brands. In other words, the revitalization of Boston Market took a back seat. Michael Andres, who was the chief executive of Boston Market at the time, did not let this announcement dampen his spirits. In an interview with The New York Times, he said, "I don't think they're going to sell the partner brands. They're committed to it. They might reposition it or restructure it, but they want to participate in the growth and opportunities that the partner brands represent."

In the summer of 2007, Andres was proved wrong: The McDonald's Corporation sold Boston Market to Sun Capital Partners, a private equity firm. Details of the sale were not disclosed, although the purchase of Boston Market was one of many made by Sun Capital during 2007. This wasn't a total aberration, as The McDonald's Corporation sold off many other brands in the mid-2000s. Chipotle, another one of McDonald's partner brands, was sold in 2006. However, many people involved in McDonald's regret selling most of Chipotle, as the brand enjoyed major success afterwards.

Sun Capital tried to revitalize Boston Market

After purchasing Boston Market, Sun Capital Partners tried to revitalize the brand on several occasions. The first effort came in 2011 and was known as the America's Kitchen Table program. This program involved Boston Market restaurants making a host of changes, from enhancing the levels of staff training and placing a greater emphasis on hospitality to the inclusion of new menu items, such as hand-carved sandwiches and squash casserole. Food presentation was also improved. All of this was undertaken with the goal of vastly elevating guests' experiences. It partly worked; Boston Market restaurants reported a boost in sales after adopting the program.

Boston Market sought to build on this success in 2013 by signing an agreement with the Army & Air Force Exchange Service. This agreement allowed them to open Boston Markets in military bases. 2013 also saw Boston Market open its first new restaurant in seven years. Located in Hialeah, Florida, the new establishment spotlit many of the changes the brand had made as part of the America's Kitchen Table program. There was even a new service line that allowed guests to view the meat as it was carved.

Another attempt to revitalize the brand was made during 2015, when the brand added ribs to its menu and doubled down on its efforts to improve customer service. Boston Market also planned a small expansion at this time that focused on opening new restaurants in states such as Florida, Texas, and New Jersey.

The chain was sold to Jay Pandya in 2020

After numerous attempts to rebuild Boston Market, Sun Capital Partners eventually sold the brand to Engage Brands of the Rohan Group, a company owned by Jingnesh "Jay" Pandya, in 2020. Prior to buying Boston Market, Pandya had a long history as a fast casual franchisee and had operated restaurants for numerous brands including Pizza Hut, Arby's, and Dunkin' Donuts. Pandya also made headlines during 2017 when he tried and failed to start the United States' first professional cricket league.

After purchasing Boston Market, Pandya wasted no time in expanding the brand. At one point, he even claimed he was opening two new locations per week. Pandya also implemented several controversial changes to Boston Market's operating practices, demanding his employees not pay the restaurant's bills unless they were heavily discounted. Predictably, the refusal to pay suppliers had dire consequences: Many Boston Market locations closed without notice. Others were forced to stock their kitchens with food bought from grocery stores.

Boston Market faced a slew of lawsuits

Jay Pandya's refusal to pay Boston Market's bills resulted in the company facing a slew of lawsuits; the chain has been sued more than 150 times since 2020. The largest lawsuit came from US Foods, a food supply and distribution service. Filed in the summer of 2023, the lawsuit claimed Boston Market owed US Foods over $11 million in unpaid bills. In February of the following year, a judge ordered Boston Market to pay US Foods $11.9 million in a default judgment, due to Pandya's repeated refusal to participate in the litigation process.

Further lawsuits have come from a number of different companies, including food supplier Ben E. Keith, which claimed that Boston Market owed it over $515,000 in unpaid goods. Polar Leasing Company, a commercial refrigerator supplier, also sued Boston Market for unpaid bills and requested a sum of $338,000 to cover costs, interest, and damages.

As well as not paying for goods, Boston Market has also made a habit of not paying rent. This has led to Boston Market being sued by various landlords and evicted from many of its restaurants. The McDonald's Corporation even took legal action against Boston Market after the brand failed to pay rent on two restaurants which McDonald's sublets.

The chain was sued by staff

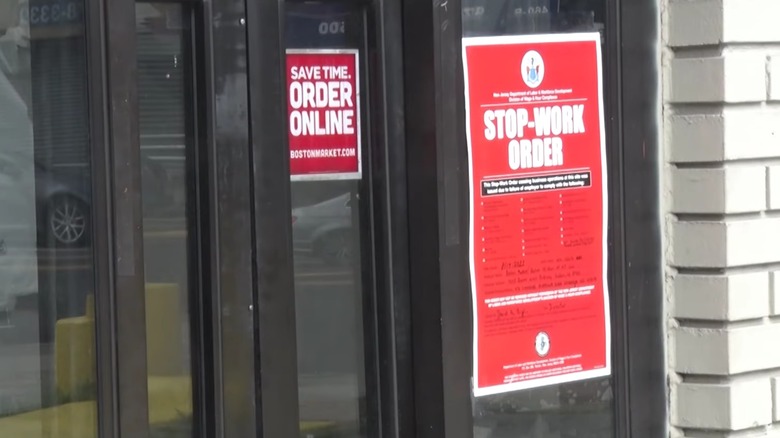

Aside from refusing to pay for food supplies, rent, and just about everything else a restaurant needs to operate, Boston Market also made a habit of not paying its staff under Jay Pandya's ownership. This was brought to the nation's attention in summer 2023, when New Jersey shut down 27 Boston Markets situated in the state after it was revealed staff were owed over $600,000 in wages. Speaking to NBC New York, New Jersey Department of Labor Commissioner Robert Asaro-Angelo said, "They need to pay their workers what they're due ... If you're not doing the right thing by workers, not only are you hurting those workers and their families, you're having an undue, unfair and illegal advantage against your competition." The employees were paid what they were owed, and the restaurants were allowed to reopen a month later.

In January 2024, a similar lawsuit was raised in Massachusetts. Here, the attorney general found that Boston Market had delayed its payments to workers and denied them access to accurate payroll records. The company was ordered to pay $104,000. Numerous regional news outlets also reported that local Boston Market workers were going without their wages. In Fall River, employees at one Boston Market claimed they hadn't been paid for an entire six week period.

Many locations were closed during 2023

Given that Boston Market has dealt with an unprecedented number of lawsuits since 2020, it should come as no surprise that many of its restaurants have closed. During 2022, Boston Market closed 41 restaurants, approximately 12% of its entire chain. While a huge amount, this was nothing compared to how many Boston Markets shuttered the following year.

It was estimated that Boston Market began 2023 with around 300 establishments to its name. According to the company's store locator, only 79 of these locations remained operational by the beginning of 2024. This means over 200 Boston Markets closed during 2023 alone. This astonishing collapse has continued into 2024. By March, around 27 Boston Market establishments remained open. This means Boston Market, a brand that once boasted over 1,000 locations, is now smaller than comparatively minor restaurant chains like Bahama Breeze or The Capital Grille.

Pandya filed for bankruptcy twice

Jay Pandya first filed for personal bankruptcy in December 2023. By January 2024, the filing had been dismissed, because Pandya failed to provide the requisite information. What's more, he did not respond to requests for further information regarding his assets during a two week period. This left the court with little choice but to dismiss his case. One month later, Pandya filed for bankruptcy again. This filing was also rejected. A judge subsequently banned Pandya from filing for bankruptcy for six months.

There are a couple of theories as to why Pandya filed for personal bankruptcy. One is that he used the bankruptcy filings to delay his other lawsuits, including the one involving US Foods. Another is that Pandya sought bankruptcy to protect his own personal wealth and potentially free him from the obligation to pay some of his many debts. Whatever the motive, his filings had little to no effect.

Franchise fees were waived in January 2024

Around the time Jay Pandya's first bankruptcy claim was dismissed, Boston Market waived its franchisee fees in an effort to tempt people into opening new locations. Specifically, the scheme targeted those who already owned establishments, including restaurants and delis, with the idea that a Boston Market could be opened within them. To further streamline this process, prospective applicants only needed to fill out a very brief questionnaire to apply. This is markedly different than other franchisee processes, which often take up to six months and involve multiple in-person meetings and assessments.

As part of this new expansion plan, Boston Market vowed to offer its restaurants a new menu item every six weeks. These dishes were designed to spotlight the cuisines of different countries from around the world. The first of these cuisines was said to be Indian, with chicken tikka and biryani slated for service at Boston Markets across the United States. However, an investigation published by Restaurant Dive in early February revealed that no Boston Market restaurants were serving these new dishes. As such, it appears to be another of Pandya's broken promises.

In spring 2024, approximately 27 locations remained

In March 2024, it was estimated that approximately 27 Boston Market locations remained open. An exact number cannot be reported, as Jay Pandya has refused to provide journalists with a list of operational Boston Markets. Despite a lack of concrete numbers, it is widely accepted that Boston Market is a shadow of its former self.

While less than 30 stores remain open, the Boston Market website still lists many more establishments on its store locator. This makes discerning which locations are actually open and which aren't incredibly difficult. What's more, the lack of communication between the company and its IT department has resulted in serious issues. One person highlighted this on Reddit, noting, "Their app and web site sometimes work, sometimes don't. Coupon codes they send out sometimes work, sometimes don't. Sometimes their app and web site let you pay with a gift card, sometimes they don't." Given this bleak customer outlook and the chain's high levels of disorganization, it seems that Boston Market's total closure is imminent.